Fed raises rates with little reaction

As expected, the Fed raised rates 25 basis points to 4.5 percent. This will raise the interest rate for Home Equity lines of credit to 7.5 percent. After the announcement, the Fed indicated that it may continue raising rates based on future economic data. According to the Fed, Core inflation remains "relatively low", but economic growth and high oil prices are a threat to price stability (inflation).

The bond markets showed little reaction to the announcement. Mortgage backed securities (MBS) prices closed little changed over the past couple of days, closing down -1/32. Tomorrow, the ISM manufacturing index and Construction Spending will be released.

Congratulations to Mr. Greenspan on a wonderful career. Today was his last day as Fed Chairman.

Rate Watch

As posted last week, interest rates were up at the close of last week. Due to a bad treasury auction and an expected Fed hike, the 30 year fixed was up to 6.12 percent slightly above the previous weeks 6.10 percent. This puts the skids on a 6-week spree of falling rates. There is consensus among Bankrate.com's mortgage experts that rates will continue to rise throughout the week. 60 percent of the contributors to the

survey believe rates are on their way up.

We’ve got a busy

economic calendar this week. It started with a

Personal Income and Outlays report this morning. Personal Income grew a modest 0.4 percent and personal outlays were up a sharp 0.9 percent (contributing to the lowest annual savings rate since 1933). The report met market expectations and there was little reaction in the bond market.

Tomorrow, the Fed's

Federal Open Market Committee (FOMC) will meet to discuss possible changes in monetary policy direction. It is expected that the Fed will again raise rates a quarter of a point to 4.5 percent and there by raising the

US Prime Rate to 7.5 percent. The more interesting market implication will come in the FOMC report, as we will get a glimpse into their judgments about future rate hikes. This will be Alan Greenspan's last meeting as

Ben Bernanke moves to replace him as Chairman of the Federal Reserve. Mr. Greenspan is retiring and has served in this role for the past 18 years.

Another potentially market moving development will come with release of the Employment Report on Friday. If the report shows a more significant increase in jobs created than the 250,000 expected, it could cause a sell-off in the bond market causing increased rates. When the economy is creating a lot of jobs in a short time frame, interest rates tend to rise.

It is a good idea to lock rates as quickly as possible. We will most likely see moderate increases in rates through out the week.

Good 2005, Bad 4th quarter

The Commerce Department

reported today that the economy grew a paltry 1.1 percent in the 4th quarter of 2005. This is the smallest growth the economy has seen in three years. The economic picture was worse than most predictors predicted. Many analysts predicted GDP growth around 2.8%. Despite a feeble 4th quarter, the economy had a solid year growing 3.5 percent through 2005. The slowdown is attributed to decline in consumer spending. Big ticket items such as appliances and cars have sharply declined. Since September 11th and the Internet bust, the consumer has bolstered the economy. Low interest rate refinances and high flying home prices have provided much of the fuel for consumer spending. With higher interest rates and higher prices at the gas pump, consumers find far less disposable income in the bank.

We would hope the Fed could look at these numbers and consider giving a boost to the economic picture by slashing rates. However, this is very unlikely at this point in time. The Core PCE deflator, the Fed’s favorite inflation indicator, accelerated to 2.2% from 1.4% in the third quarter. Curbing inflation is the Fed's number one concern. When the Fed meets next Tuesday, you can expect to see another rate hike.

Mortgage rates are unchanged on the day. This reflects a wait and see attitude on next week’s Fed meeting.

Rates turn upward

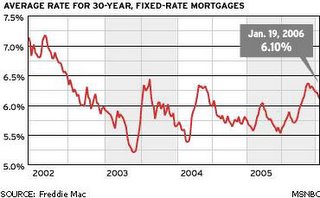

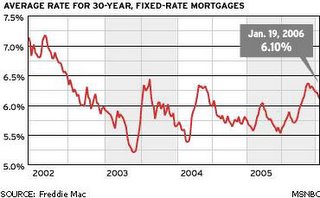

After falling for 6 straight weeks, mortgage rates took an upward tick. Freddie Mac's weekly

survey shows rates on the 30-year fixed rate mortgage up to 6.12 percent from last week's 6.10 percent. Investors are reacting to an expected rate hike by the Federal Reserve next Tuesday.

This week's Must Reads

LocalNot Local

Is the Boom over?

Yesterday, the National Association of Realtors released their

existing home sales report. It reports that existing home sales fell a seasonally adjusted 5.7 percent in December. The Southern Region (of which Houston is a member) dropped off 7.2 percent, the biggest drop of any other region. The biggest category decline occurred in the Single Family home sector, which dropped 6.8 percent. This could mean that speculation in the condo market continues (sales increased 1.6 percent), but the average family is starting to pull back.

Does this report mean the boom is over? Well, NAR's Chief Economist David Lereah predicted in a separate

report that home sales would fall off about 5 percent. This would be a little disconcerting if the NAR wasn't so consistently wrong in their predictions. A

blogger for the

New York Times has taken the NAR's own press releases and compared their predictions to actual year end results (

here). I know predicting the future is not an easy proposition, but these guys are terrible. If you asked them to make your Super bowl prediction, they might pick the Texans to win. So if Mr. Lereah is to be believed, we should have another great year.

Mortgage apps continue to rise

For the third straight week, mortgage applications continued to climb. This is a result of the lowest Interest Rates we've seen since October. This is obviously good news for the industry, let's hope the good times roll into the spring and summer. Here are the

details as reported by

CNNMoney.com:

The Mortgage Bankers Association said its seasonally adjusted index of mortgage application activity for the week ended Jan. 20 increased 7.7 percent to 660.5 from the previous week's 613.3

The group's seasonally adjusted index of refinancing applications increased 7.8 percent to 1,773.9, compared with 1,645.2 the previous week. The index increased for a fourth consecutive week.

Borrowing costs on 30-year fixed-rate mortgages, excluding fees, averaged 6.04 percent, down 0.03 of a percentage point from the previous week's 6.07 percent, marking its seventh consecutive weekly decline. Rates were at their lowest level since the week ended Oct. 7, when they reached 5.98 percent.

The MBA's seasonally adjusted purchase mortgage index increased 6.7 percent to 473.7, erasing a slide of 3 percent the prior week. The index is considered a timely gauge on U.S. home sales.

Realtors aren't going anywhere

The National Association of Realtors® released their annual

Profile of Home Buyers and Sellers last week. According to the survey, 9 out of 10 home buyers use real estate agents during their search. Even though 77 percent of home shoppers use the Internet to find the home, they still relyed on agents for the most value added pieces of the transation: negotiation, consultation, and closing.

Additionally, the FSBO market continues to decline. Only 13 percent of transactions were conducted without an agents assistance, 39 percent of which were between parties that knew each other in advance.

Rate Watch

Falling for the 6th straight week, mortgage rates hit a 3 month low. According to Freddie Mac's

weekly survey, the 30-year fixed rate mortgage dropped to 6.1 percent from the previous weeks 6.15 percent. If stocks continue to fall this week, rates should continue to fall. Bankrate.com's

mortgage experts don't believe this trend will continue. Only 20% of the mortgage pros surveyed believes rates will fall over the next 30-45 days. The rest are split among rate staying pat or rising. If their opinion counts (and I believe it does), it continues to be a good time to lock rates.

In a continued trend toward a flattening yield curve, one-year adjustable rate mortgages were up 3 basis points to 5.18 percent. As Spencer stated in a

post last week, 30-year fixed rate mortgages continue to be the best bet for mortgage shoppers.

The week ahead will be a little slow on the economic indicator front. The most interesting release will be the Initial GDP estimates for the 4th quarter will be released on Friday. GDP growth is expected come in below 3 percent for the first time in 11 quarters. Until that release the market will probably move based on geopolitical news.

The Beige Book

The Fed’s latest

Beige Book had some good news and some bad news for the real estate pros. The Beige Book is an anecdotal analysis of the Fed's 12 regions. The good news is the Dallas District, of which Houston is apart,

reports strong housing activity. The bad news is the report raises concerns regarding inflation. According to the report, "contacts in many industries expressed concerns about high or rising costs." These rising costs then led to higher prices. This coupled with strong economic expansion provides some real inflationary pressure, which could lead to higher mortgage rates in the near future.

This Week's must reads

Local

Not Local

US Housing Starts report released

The Housing Start

report issued by the Census Bureau and HUD was release today. Housing starts dropped more than economist predicted for December. Although this decline was seen in the US as a whole, the Southern region (which includes Texas) did see an increase of 5.2 percent. This increase might have been attributable to the construction associated with Hurricane's Katrina and Rita.

Mortgage rates continued to edge down yesterday as Mortgage-backed securities (MBS) yields dropped to 6.07 percent on the 30-year Fixed and the 30-year Fixed Conforming rate dropped to 6.15 percent. It remains a good week to lock your rates.

CPI shows moderate inflation

Many of the news articles today stated that the Consumer Price Index (CPI), a key indicator of inflation at the retail level, dropped for the month of December. This is misleading considering most of the decrease in prices was due to falling oil prices. As we all know oil prices have again moved up quite a bit in the past couple weeks, due to fears over Iran the world’s 3rd largest oil producer. The core CPI (CPI minus food and oil) which is typically a better indicator of inflation went up to along market expectations to .02%. This reveals moderate inflation and some pundits believe could be accelerating. If this is the sentiment felt by the Fed, we'll probably see a rate hike at the end of the month.

On the bond market front, Treasury yields took an initial dive, but returned back to Tuesday levels. The 10-year Treasury is at 4.34 percent and the 2-year Treasury is at 4.33 creating an inverted yield curve. If you believe that history is an indicator of the future, that ain't good. Five out of the last six inverted yield curves were followed by an economic recession. Although many experts believe that this particular inverted yield curve will not produce those results. Let's hope they're right and rates stay relatively low throughout the year.

Title Companies cutting a fat hog!

CNN Money has an

article chastising the Title Insurance industry for excessive fees. According to the American Land Title Association (ALTA), the Title Insurance industry only pays out approx. 4% of its premium. I like those odds. These guys don't like to lose.

As you would expect from an author brought to you by CNN, the writer suggests a government managed system would work best. I would argue that premium because of government intervention, not in spite of it. If the state got out of the business of setting premiums, we would all be in better shape. Every couple of years the Texas Department of Insurance cracks down on the marketing practices of Title companies. Maybe they should start cracking down on absurdly high premiums.

Housing Starts Surge

Metrostudy reports that housing starts in Houston surged last year. Up 18% from last year, Houston area builders constructed 48,000 homes in 2005. In a

Houston Chronicle article, Metrostudy's president Mike Inselmann predicted that the industry will maintain those numbers in 2006 even if we see 7% interest rates. If his assumption is correct, then I think it will be a good year for homebuilders. This of course will be contingent on continued economic growth in the Houston area. Let's hope the energy prices hold strong, and our friends at the

Greater Houston Partnership can get some big relocation wins this year.

Rate Watch

For the 5th straight week the 30-year Fixed fell. Dropping to a 6.15 percent average, the 30-year was down from last week's average of 6.21 percent. Long-term mortgages rates continued to fall due to economic data released last week that pointed to restrained inflation over the near term. It might be a good time to lock rates.

Freddie Mac also reports that short term rates are holding steady. 5/1 ARMs averaged 5.76 percent this week down very slightly from last week's 5.78 percent. 1-year ARMs averaged 5.15 percent this week down from last week's 5.16 percent average. We haven't seen much movement due to expectations of another Fed rate hike at the end of the month.

The economic calendar should be an interesting one. The most interesting for the real estate industry being the Housing Starts report. This can be a leading indicator for the health of the real estate industry. According to Barron's, "Housing activity is expected to moderate, but housing starts do jump around from one month to the next, so it is important to look at the 6-month moving average, the period that the Census Bureau claims it takes to establish a trend."