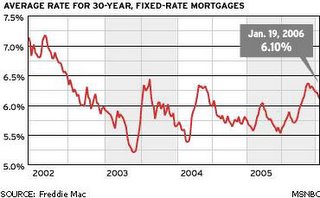

Rate Watch

Falling for the 6th straight week, mortgage rates hit a 3 month low. According to Freddie Mac's weekly survey, the 30-year fixed rate mortgage dropped to 6.1 percent from the previous weeks 6.15 percent. If stocks continue to fall this week, rates should continue to fall. Bankrate.com's mortgage experts don't believe this trend will continue. Only 20% of the mortgage pros surveyed believes rates will fall over the next 30-45 days. The rest are split among rate staying pat or rising. If their opinion counts (and I believe it does), it continues to be a good time to lock rates.

In a continued trend toward a flattening yield curve, one-year adjustable rate mortgages were up 3 basis points to 5.18 percent. As Spencer stated in a post last week, 30-year fixed rate mortgages continue to be the best bet for mortgage shoppers.

The week ahead will be a little slow on the economic indicator front. The most interesting release will be the Initial GDP estimates for the 4th quarter will be released on Friday. GDP growth is expected come in below 3 percent for the first time in 11 quarters. Until that release the market will probably move based on geopolitical news.

1 Comments:

rates will be in the 3's in 10-15 years.

Post a Comment

<< Home