Good news on Inflation, Mortgage rates are down

Although there have been a multitude of inflationary pressures arising in the economy (i.e. rising energy costs, slowing productivity, rising wages), it appears something is proving to beat down inflation. The Consumer Price Index (CPI) was released today, and Wall Street was extremely happy with the results. CPI rose 0.1% in February, after jumping 0.7% a month earlier. The Core CPI, which excludes more volatile food and energy prices, was also up 0.1%, according to the Commerce Department. The report showed a decrease in energy and clothing costs, an unsurprising rise in medical costs, plus moderate increases in food and housing.

This is very good news for the Fed. In 14 consecutive meetings, the Federal Open Markets Committee has raised their Federal Funds Rate. The raising of the Fed Funds Rate is the Fed’s most powerful weapon in their fight against inflation. And based on this report, their efforts appear to be working. If moderate inflation becomes the trend, then the FOMC can look to end their rate raising binge. Unfortunately, we'll have to wait until April's report to know for sure, but this is very good news. In the meantime, we can expect another rate hike at the end of the month.

The bond market's reaction was very positive. As reported by Bloomberg, "The yield on the benchmark 10-year note fell 2 basis points to 4.71 percent at 9:49 a.m. in New York, according to bond broker Cantor Fitzgerald LP. The yield, which moves inversely to the note's price, is down from 4.80 percent on March 7, which was the highest since June 2004. A basis point is 0.01 percentage point."

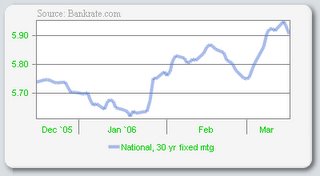

On the mortgage interest rate front, Bankrate.com's overnight average is at 5.91 percent down from last week's 5.92 percent. Obviously, we'd like to see a more significant decline. But considering last Tuesday's overnight average was up 20 basis points from the previous week, I think we should all be more than happy with this week's performance thus far.

0 Comments:

Post a Comment

<< Home