Links of the Week

Houston National

Houston National

Houston economy still lookin' good

Even though the rest of the country might not like'em, those high oil prices sure make for a good Houston and Texas economy. In both Houston and Texas, the unemployment has dropped from the previous month. Here's the report from

Houston Business Journal:

Texas gained 25,400 jobs in February, according to labor market figures released Thursday by the Texas Workforce Commission.

The state added a total of 279,700 jobs over the 12 months ended February 2006 for an annual growth rate of 2.9 percent statewide.

Texas' seasonally adjusted unemployment rate for February 2006 stands at 5 percent, down from 5.4 percent in February 2005.

In the Houston-Sugar Land-Baytown metropolitan statistical area, the not seasonally unemployment rate dropped to 5.3 percent compared with February 2005's rate of 5.9 percent.

There were about 142,600 unemployed people in the area, down from 154,600 unemployed in February 2005.

Mortgage applications rise

Driven by new home purchases, the number of mortgage applications has risen for the first time in three weeks. Here are some snippets from a report from

Bloomberg:

A measure of U.S. mortgage applications rose last week, rebounding from the year's lowest level as home purchases increased.

The Mortgage Bankers Association's index of applications to buy a home or refinance an existing mortgage rose 1.2 percent to 571.7 from 565 a week earlier, the group said today. The gauge of purchase applications increased 2.7 percent to 404.1 the week ended March 24 from 393.6.

Mortgage applications rose for the first time in three weeks, suggesting consumers may be pursuing bargains with a record number of new homes on the market. Home sales are expected to fall this year for the first time since 2000, putting a weight on total economic growth...

...Adjustable-rate mortgages are becoming less attractive as the Federal Reserve raises short-term interest rates. Fed policy makers yesterday raised their benchmark interest rate for a 15th consecutive time, to 4.75 percent from 4.5 percent.

Higher mortgage rates and prices are making housing less affordable and will lead to a slowdown in sales this year, David Seiders, chief economist at the National Association of Home Builders, said in an interview on March 24...

...Cash extracted through refinancing may drop to $117 billion this year, from an estimated $243 billion in 2005, according to a report last month from Freddie Mac, the No. 2 buyer of mortgages. Consumer spending probably will cool to a 2.9 percent rate by the end of the year from the current quarter's 4.7 percent, according to a Bloomberg News survey of economists taken from Feb. 27 to March 7.

The share of total applications represented by refinancing fell to 37.3 percent last week, from 38.1 percent the week before. Adjustable-rate mortgages applied for rose to 28.7 percent of the total from 28.3 percent.

Sales of new and existing homes will fall 6.1 percent to a combined 7.85 million this year, the National Association of Realtors said on March 13. That level would still be the third- highest on record.

Fed raises rate and there's no end in site

Well we've got a new Fed Chief, but like it or not, we've got the same Fed. In his first meeting as Fed Chairman, Ben Bernanke and the

Federal Open Markets Committee (FOMC) raised the

Federal Funds rate a 1/4 point. It was the fifteenth consecutive increase since June 2004. This move will immediately raise the monthly payments on

Home Equity Lines of Credit as well as credit card debt. And it appears that they are not stopping with this one. As I posted yesterday, the key thing to watch for would be the verbiage used by the Fed to justify the increase. The Fed chose the exact same language when they raised rates last month.

"The Committee judges that some further policy firming may be needed to keep the risks to the attainment of both sustainable economic growth and price stability roughly in balance. In any event, the Committee will respond to changes in economic prospects as needed to foster these objectives."

After the announcement, Treasury yields were on their way up. According to

Reuters, the yield on the benchmark 10-year Treasury was at 4.77 percent at 2:25 p.m. versus 4.71 percent late on Monday. We can expect mortgage rates to move in the same direction.

Here's some further

analysis from Joel Naroff, Chief Economist at Commerce Bank:

The more things change, the more they remain the same. At least for now. This was the first FOMC meeting for Fed Chairman Bernanke and just like the last fourteen that Mr. Greenspan ran, it ended with a 25 basis point increase in the funds rate. So, we now have fifteen consecutive meeting, spanning twenty months, where short-term rates were hiked by ¼ percentage point.

While the increase in the funds rate was a given, the questions we had before the meeting had to do with the wording of the statement. Would it be changed significantly? Would hints be given about when the Fed might stop raising rates? The answers are a little and no.

Let’s start with the description of the economy. It was a little more descriptive and seemed to provide some additional information about the Committees thinking. In particular, it indicated that neither the cold fourth quarter nor the hot first quarter accurately measured the likely future path of economic growth. Instead, the Committee noted that the economy “appears likely to moderate to a more sustainable pace.”

What about future rate hikes? The Committee repeated that it “judges that some further policy firming may be needed to keep the risks to the attainment of both sustainable economic growth and price stability roughly in balance.” In other words, the likelihood of another rate hike remains the same today as it did the day of the last meeting. That is, it is likely.

Inflation remains the worry. While the statement largely echoed the concerns about tightening labor markets and rising energy costs previously stated, commodity price pressures were added to the list. This seems to heighten the concern that inflation could accelerate. And one thing the Fed will not tolerate is rising inflation.

Basically, the new boss has the same worries as the old boss. And maybe more so. For the markets, this cannot be good news. Investors were hoping there would be some indication that the tightening cycle would be coming to an end. Their hopes were dashed.

Rate Watch

For the second straight week, the results of Freddie Mac's

weekly survey resulted in a lower average interest rate. The benchmark 30-year fixed rate mortgage is averaging 6.32%, down from the previous week's 6.34%. The average for the 15-year fixed rate mortgage was also down, settling in at 5.97%. The popular program was down slightly from last week’s average of 5.98%. In contrast, short term programs were up. The One-year Treasury-indexed ARMs averaged 5.41% this week, up from last week when it averaged 5.37%.

On average, I would say last week was rather unremarkable. The market moved slightly up or slightly down depending on the news, but no long term trend emerged. The February

Producer Price Index came in much lower than expected at -1.4%, versus a consensus of -0.2%. However, the more closely watched "core" PPI, which excludes more volatile energy and food costs, rose 0.3%, more than the forecasted gain of 0.2%. Overall, the report proved to be a neutral event.

Housing sales were also a mixed bag. On the one hand,

Existing Home Sales increased 5% to 6.91 million annual units, far exceeding the consensus estimate of 6.50 million. On the other hand,

New Home Sales were much lower than expected at 1.08 million compared to a consensus of 1.21 million. Since a slow down in the real estate market would make it less likely that the Fed would need to continue to raise rates, mortgage rates moved slightly down on the new home sales news.

Despite these mixed economic indicators, there seems to be a growing consensus that inflation is under control. If the Fed is in agreement with this consensus, then we could see some evidence this week. The

Federal Open Market Committee (FOMC) meets on Tuesday to discuss the economy and the prospects for future rate hikes. Another 25 basis point hike is considered a sure bet, but the statement following the meeting will be the main driver of the market. As the end to the rate hikes approaches, the wording of the statement becomes more critical. If the statement indicates that the Fed believes the inflation is coming under control, you can bet on falling interest rates. If not, rates will be on there way back up.

Beyond the FOMC meeting, the

economic calendar will be a broad range of events, but no other report will have the impact. The final revisions to 4th quarter 2005 GDP will be released on Thursday. GDP is the most comprehensive measure of economic activity, but by the time we get around to its third release the impact is less significant. The Chicago PMI national manufacturing index and Personal Income, two solid mid-level reports, will both come out on Friday. We also will be taking a look at consumer feelings. Reports on Consumer Confidence and Consumer Sentiment are also on the schedule next week.

Once again, all things will pale in comparison to the FOMC meeting. The Fed’s post meeting announcement will have a big impact on where rates go this week. It is not wise for borrower’s to float rates through an FOMC meeting. If borrower’s can lock rates today, they should.

Treasury yields fall on news of New Home declines

New home sales were down in February, and the results were weaker than expected. This caused US Treasury yields to decline, and we can expect mortgage rates to follow. Here's the whole

story from Reuters:

U.S. Treasury debt prices extended gains on Friday on weaker-than-expected February new home sales data, which suggested the Federal Reserve's 21-month monetary tightening campaign may well be nearly done.

New home sales came in at an annual rate of 1.080 million units, falling short of economists' expectations of 1.200 million. The government also revised down January's result to 1.207 million from 1.233 million.

Benchmark 10-year notes US10YT=RR, up in early trade on data showing weaker-than-expected business investment, extended gains to trade 8/32 higher for a yield of 4.70 percent versus 4.74 percent late on Thursday.

Links of the Week

HoustonNational

Existing home sales unexpectedly rise

Here's the

report from Reuters:

U.S. Treasury debt prices turned lower on Thursday on an unexpected rise in existing home sales in February, which encouraged views that the Federal Reserve will raise short-term rates at least two more times.

Sales of existing homes rose 5.2 percent to a seasonally adjusted annual rate of 6.91 million units, according to the National Association of Realtors. That compared with economists' expectations of 6.5 million and January's upwardly revised 6.57 million unit pace.

Benchmark 10-year notes turned 2/32 lower for a yield of 4.72 percent versus 4.71 percent on Wednesday.

Inflation uncertainty pushes Treasury yields back up

Huh? What is going on with inflation? Those are the questions the market is mulling over at the moment. After a great

Consumer Price Index (CPI) report last week, the

Producer Price Index showed higher than expected inflationary pressure. A sharp drop in energy prices caused big declines in producer prices, which by itself sounds like good news. However, "core" PPI, which excludes more volatile food and energy prices, increased much higher than Wall Street had forecast. This caused Treasury bond prices to fall and their yield to rise. A bond's price and yield move in opposite directions. As reported by

Reuters at 11:28 a.m., the benchmark 10-year Treasury note fell 14/32 in price, pushing yields up to 4.72 percent from 4.66 percent. You can expect overnight mortgage rates to move in the same direction.

For a more detailed analysis of today's Producer Price Index report, here are some

comments from Joel Naroff, Chief Economist for Commerce Bank:

WHAT IT MEANS: A strange winter has led to some strange changes in wholesale prices. The Producer Price Index fell sharply in February as both energy and food cratered. But excluding these factors, prices rose a bit faster than expected. So what is going on here? First, there’s energy. It was down sharply but has rebounded, so watch out for the March number. As for food, those prices fell a huge amount as well. Just about every food product was down, which is absolutely amazing. I can understand vegetables, as the hurricane impacts are now behind us. But eggs, chickens, turkeys (no, I don’t think it’s due to bird flu scare), dairy and even confectionery product prices were off. I can’t explain that. As for non-food and energy (core) prices, they rose moderately for the third time in four months. That included consumer goods and capital equipment. Looking at the pipeline, pressures are building. Core prices continue to rise faster than would be considered comfortable and at the intermediate level they have been surging for the past six months. That is a warning sign, though as I say every month, the pathway from wholesale to retail prices is about as clear as mud.

MARKETS AND FED POLICY IMPLICATIONS: The Fed continues to focus on inflation and while wages may be the key concern, further rises in wholesale prices cannot make the FOMC members sleep comfortably. The issue though, is how much gets passed through. That is more a matter of pricing power. But if wages and input costs are rising, then the stage is set for an uptick in inflation. A rate hike is expected at next week’s FOMC meeting and if I read Mr. Bernanke’s speech correctly, the bias may be toward somewhat higher rates. But if anyone really thought Mr. Bernanke would be clearer than Mr. Greenspan, they were kidding themselves. Instead of density, we now have academic obfuscation. Meet the new boss, same as the old boss.

Rate Watch

It has been a wild and crazy month. March has proved to be one of the more volatile months for mortgage rates in a long time. And last week was no exception. After soaring rates for 2 straight weeks, we got a little relief. Freddie Mac's weekly

average dropped 3 basis points to 6.34 percent on the benchmark 30-year Fixed Rate Mortgage (FRM). Other programs dropped as well. The average for the 15-year FRM was at 5.98 percent, down from the previous week’s average of 6.00 percent. The One-year Treasury-indexed ARM averaged 5.37 percent last week, down from the previous week's 5.45 percent.

Rates have shifted direction primarily due to better attitudes regarding inflation. Lower rates came courtesy of February's

Consumer Price Index or CPI, which was released last week. CPI came in lower than market expectations, rising just 0.1%. Its counterpart "core" CPI, which excludes more volatile food and energy prices, also came in below the forecasts at 0.1%. These results brought much needed good cheer with respect to inflation and the possibility for future Fed rate hikes. For the past couple of weeks, analysts have been working under the assumption that the Fed will raise rates at least 3 more times and there by bring the

Federal Funds Rate up to 5.25%. Now Wall Street is leaning more towards a Fed Funds rate high of 4.75% or 5.00%. Considering, the Fed has raised rates in 16 consecutive sessions of the

Federal Open Markets Committee (FOMC), this would be a welcome relief. Most of the time, mortgage rates and the Fed Funds rate move in the same direction.

This week's

economic calendar is pretty bare. The biggest news of the week will probably come on Tuesday with the release of the

Producer Price Index (PPI). While the CPI is a measure of prices on the finished goods that you might buy at the store, PPI measures the price of materials used by manufacturers to make finished goods. If PPI reflects moderate inflation numbers similar to last week's CPI, then we could see additional declines in mortgage rates.

Existing Home Sales and New Home Sales will be released on Thursday and Friday respectively. Although, they won't have much of an impact on rates, they will be of interest to real estate professionals. If buyers are starting to hold-off due to rising rates, the Home Sales reports should give us some insight.

Finally, the

Durable Orders report will allow us some insight into the economic health of corporate economics. That report is scheduled for release on Friday.

This week’s panel of

experts at

Bankrate.com are split in their rate forecasts. Half of the panelists believe rates will rise in the next 35 to 45 days, while the other half believes rates will either stagnate or fall. Sense there is so much uncertainty in the market right now, it would probably be best for borrowers to lock rates as soon as possible.

Links of the Week

Houston Links

National Links

Good news on Inflation, Mortgage rates are down

Although there have been a multitude of inflationary pressures arising in the economy (i.e. rising energy costs, slowing productivity, rising wages), it appears something is proving to beat down inflation. The

Consumer Price Index (CPI) was released today, and Wall Street was extremely happy with the results. CPI rose 0.1% in February, after jumping 0.7% a month earlier. The Core CPI, which excludes more volatile food and energy prices, was also up 0.1%, according to the Commerce Department. The report showed a decrease in energy and clothing costs, an unsurprising rise in medical costs, plus moderate increases in food and housing.

This is very good news for the Fed. In 14 consecutive meetings, the

Federal Open Markets Committee has raised their

Federal Funds Rate. The raising of the Fed Funds Rate is the Fed’s most powerful weapon in their fight against inflation. And based on this report, their efforts appear to be working. If moderate inflation becomes the trend, then the FOMC can look to end their rate raising binge. Unfortunately, we'll have to wait until April's report to know for sure, but this is very good news. In the meantime, we can expect another rate hike at the end of the month.

The bond market's reaction was very positive. As

reported by

Bloomberg, "The yield on the benchmark 10-year note fell 2 basis points to 4.71 percent at 9:49 a.m. in New York, according to bond broker Cantor Fitzgerald LP. The yield, which moves inversely to the note's price, is down from 4.80 percent on March 7, which was the highest since June 2004. A basis point is 0.01 percentage point."

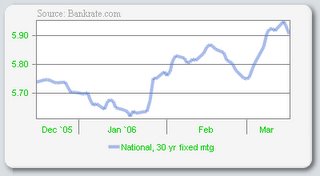

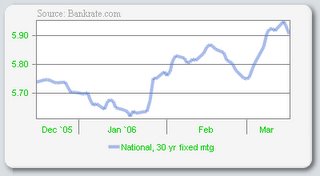

On the mortgage interest rate front,

Bankrate.com's overnight average is at 5.91 percent down from last week's 5.92 percent. Obviously, we'd like to see a more significant decline. But considering last Tuesday's

overnight average was up 20

basis points from the previous week, I think we should all be more than happy with this week's performance thus far.

Treasury Yields go down with Consumer Spending

Bloomberg.com

reports that treasury prices (prices and yields/interest rates move in opposite directions) are up after the Retail Sales report showed that consumer spending might be waning. According to the Commerce Department report, retail sales dropped 1.3 percent last month, compared with a gain of 2.9 percent in January. The decline in consumer spending alleviates some of the market's concerns over inflation. The yield on the 10-year note fell 2

basis points, to 4.74 percent by 8:54 a.m. Consumer spending's decline is not and established trend. New information in other areas could easily push yields back up. I'll keep you apprised of developments.

Mortgage Rates hit 2 year high

Following continued concerns over rising global interest rates, bond investors continued to push mortgage rates even higher than last week. According to Freddie Mac's

weekly survey, the average on 30-year fixed rate mortgages was up 13

basis points to 6.37 percent. This is the highest average Freddie has reported since September 5, 2003. The average for a 15-year fixed-rate mortgage rose to 6 percent, the highest level since July 2002 and an increase from 5.89 percent last week. One-year Treasury-indexed ARMs averaged 5.45 percent this week up from last week when it averaged 5.34 percent.

As you may

recall, Europe decided to raise interest rates last week. This week it was the Bank of Japan's

turn. For the first time since 2001, Japan's central bank decided to raise their benchmark rate above zero. This forced many investors and fund managers to re-evaluate their portfolios. In order to keep these investors from dumping US Treasuries for more attractive Japanese and European bonds, sellers of treasuries were forced to sell at higher yields (i.e. interest rates). Because Mortgage-backed securities dealers have to compete as well, rising yields resulted in higher mortgage interest rates.

On Friday, the US government

announced the creation of 243K new jobs. This was a little stronger than Wall Street expected, but it was within the margin of error. The report also revealed a more confidant work force. As job growth rose, the unemployment rate rose from the previous month's 4.7 percent to 4.8 percent. This is good news because the unemployment study only considers those actively looking for a job as unemployed. If job growth and rising unemployment are growing at the same time, then those individuals who gave up on finding work must have re-started their search. This is good for the economy and real estate professionals, because the gainfully employed tend to buy houses. However, it is not good for the prospects for inflation. Strong job growth can lead to a higher inflation rate, which would lead to higher interest rates. This gives the Fed another excuse to kick in another rate hike to offset inflation.

Beginning with Tuesday's release of

Retail Sales, this week's

economic calendar will feature a broad range of economic events. The Retail Sales report measures the level of consumer purchases, which represents 70% of economic activity. The biggest possible market mover will be the

Consumer Price Index (CPI) to be released on Thursday. This is the most watched measurement of inflation, and inflation is the arch enemy of interest rates. Also on Thursday, we'll get to see the affect of rising interest rates when the

Housing Starts report is released. On Friday

Industrial Production data shifts the focus to output by businesses.

I don’t expect rates to move in the dramatic fashion we saw last week. Borrowers should be vigilant of the market, and lock rates when possible. Rates will probably go up, but I expect it to be a modest.

This week's Must Reads

LocalNot Local

Treasuries are up, Mortgage rates follow

On Tuesday, the 10-year

rose as high as 4.81 percent on Tuesday, up from Monday's 4.75 percent and last week's 4.55 percent. And unlike last week, Mortgage rates have followed. Bankrate.com's

overnight average was 5.86 percent this morning up 5 basis points from Monday. Inflation fears and rising global interest rates have been the main contributors to rising rates.

The inflation fears stem from the Labor Department’s

Productivity report. For the first time in four years, American workers are less productive but are making more money. American productivity, a key indicator of rising standards of living, fell to an annual rate of 0.5 percent in the 4th quarter of 2005 and wages rose at a 3.3 percent pace. The report was released Tuesday morning.

For many years, the American economy did not have to worry much about inflation, because an ever efficient workforce kept it in check. As productivity rises, companies can produce more goods and services with fewer workers. Much of the jump in productivity had to do with the Internet as well as faster and faster computer processing speed. If productivity begins to stagnate or decline, it will cost companies more money to produce their goods and services. This could in turn lead to higher inflation rates. And as we’ve said many times, inflation is a bond’s arch nemesis.

On the global front, it’s the same story as last week. As

posted on Monday, rising rates in Europe led to last week’s spike in US Treasuries. This week it’s Japan’s turn to get in on the action. The Bank of Japan, Japan’s version of our Fed, will meet today and tomorrow to discuss the possibility of raising short-term interest rates. This is a big decision, because borrowing money in Japan is cheap, real cheap. In fact, it is almost zero. They enacted this policy in 2001 to spur a stagnant economy. No one really knows how the markets in Japan or globally will react to a move to increase borrowing in Japan. Because of the policy, many fixed-income investors in Japan have bought their low risk bonds from Europe and America to receive a higher return than they were getting at home. The fear is that once Japan begins to raise rates those investors will bring their money back home and invest in home grown bonds. The Japanese are one of the US’s biggest purchasers of US Treasuries. If they decide to take their money and go home, it could mean less demand and higher yields in the US. The Bank will release their decision tomorrow.

[click here for additional information]Now after I’ve scare you to death, let me calm you down. Treasury yields came

down a bit by the close of the market on Tuesday and remain steady today. There is still concern that they will continue to rise, however it might be that the market has adjusted sufficiently to address its fear of Japan and inflation. But I would still be cautious, and lock rates ASAP.

Rate Watch

After a peculiar 2 week drop in mortgage rates, it appears reality is beginning to set in. On Thursday,

Freddie Mac released its weekly Primary Mortgage Market

survey. The survey showed a second consecutive decline in mortgage rates. Rates on the benchmark 30-year fixed rate mortgage averaged 6.24 percent, a decline from the previous week's 6.26 percent. The decline has stricken many experts as odd. As mortgage rates were falling, US Treasuries had been on the rise. Mortgage rates and Treasuries typically move in lock step. But as Freddie Mac was releasing its survey, rates were already on there way up. A rate hike by the European Central Bank (their version of the Fed) caused the mortgage market to adjust their prices to keep investors from taking their money overseas. Bankrate.com's

overnight average has moved from last week's 5.78 percent to 5.81 percent and the benchmark

10-year Treasury is at its highest levels since June of 2004. We can expect next week's Freddie survey to reflect higher interest rates.

In other programs, rates on 15-year mortgages remained at 5.89 percent, Freddie Mac said, while one-year ARM's rose to average 5.34 percent from the previous week's 5.32 percent.

This week, the biggest release on the

economic calendar is the belated

Employment Report for February. The

Bureau of Labor Statistics fell a little behind last week, and needed an extra week to gather together all their data. So what we should have known last Friday will be know this Friday. The Employment provides us with the number of new jobs created and the Unemployment Rate and it is one of the most important reports of the month. The health of the labor market is arguably the single biggest indicator of an economy's performance.

Besides the

Pending Home Sales and

Mortgage Applications reports, which might be of interest to Real Estate pros, there is little else on the US economic calendar that will affect mortgage rates. Both the

Productivity and

Trade Balance reports are more relevant of long-term changes, and won’t affect the short-term movement in rates.

This week's Must Reads

LocalNot Local

Mortgage Wars

Holden Lewis,

Bankrate.com's resident blogger has an interesting article about the unusual goings on in the mortgage markets. As I posted yesterday, mortgage rates are down on the week as Treasury yields are going up. This is very unusual because these two securities typically move in the same direction. Holden's theory is that there must be a bidding war in the mortgage markets and this is bound to end eventually. So he reccomends locking rates, because you don't want to get caught on the back end of this battle. Here's Holden's

post:

MORTGAGEY WEIRDNESS: I think you should lock your mortgage rate. Something is going on in the mortgage world -- maybe a price war. And wars end sooner or later.

Bankrate conducts its mortgage rate survey every Wednesday, and this week's survey found that the 30-year fixed fell for the second week in a row, to 6.27 percent. The signs pointed toward a rise, not a fall.

Let's compare Wednesday to the previous Wednesday -- March 1 to Feb. 22.

On Feb. 22, the 10-year Treasury yielded 4.53 percent. On March 1, the 10-year yielded 4.59 percent. On Feb. 22, one of Freddie Mac's required net yield was 6.01 percent. On March 1 it was 6.08 percent. The required net yield is sort of like the wholesale price of a loan. To recap, the 10-year Treasury yield went up 6 basis points and the Freddie required net yield went up 7 basis points, but the average rate on a 30-year fixed fell 7 basis points. Mortgage rates and bond yields usually move in the same direction.

Let's look at the difference, or spread, between the 10-year Treasury yield and the average 30-year mortgage rate. This week it was 1.68 percent; last week it was 1.81 percent. At the beginning of 2006, the spread was 1.92 percent. A spread of 1.68 is narrow. It has dropped that low twice since October, and both times it snapped back within a couple of weeks to 1.75 or higher.

As I write this, the 10-year yield is 4.64 percent. If the 30-year fixed were 1.75 percentage points higher than the 10-year Treasury yield, it would be 6.39 percent right now -- an eighth of a percentage point higher than the benchmark 30-year fixed in this week's Bankrate survey.

The spread between the 10-year Treasury and the 30-year fixed probably will widen in the next two or three weeks; if that happens, mortgage rates will rise unless Treasury yields fall.

Mortgage rates continue to fall

Based on

Bankrate.com's overnight averages, mortgage rates were down from 5.81 percent to 5.75 percent. Rates keep on sliding which is good for all of us.

However, this trend may not continue. The

release of the ISM's February Index showed accelerating manufacturing output. This is a sign that the economy is running at a pretty good clip and accelerating growth can lead to higher inflation. In reaction, Bond investors bid down the benchmark 10-year Treasury bond. Yields on the 10-year note rose 2

basis points to 4.57 percent. The 10-year Treasury is a good indicator of where long-term debt (such as the 30-year Fixed Rate Mortgage) will move.

Houston

Houston